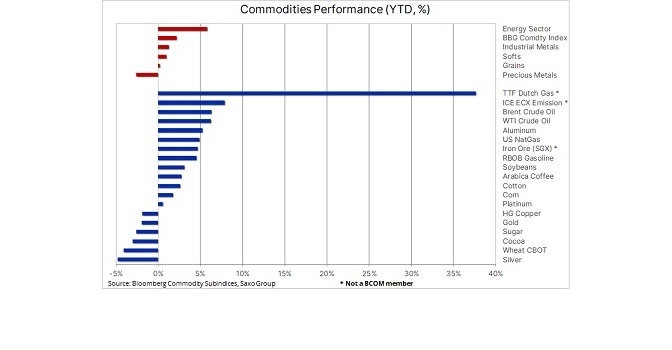

WCU: Commodities stagger as 2022 gets underway

By Ole S. Hansen January 8, 2022

Turbulent best described the first few trading days of 2022, and just like the nervous start to 2021, it was a sharp rise in US Treasury yields that provided the initial directional inspiration across the different asset classes. The jump in sovereign bond yields from Japan to Germany and the UK gathered momentum after minutes from the Fed’s December meeting raised expectations for an accelerated pace of Fed rate hikes to combat inflation while the FOMC also discussed ways to outright reduce its balance sheet, thereby further removing some of the oxygen that had been driving stock markets sharply higher during the past three years.

These moves signaled an interest from the Fed to guide bond yields higher, not only at the front but across the whole curve. The benchmark ten-year yield jumped to within touching distance of the 1.77% high from last April.

Precious metals, with gold in particular being one of the most interest rate-sensitive commodities, traded lower, but not to the extent that the 0.3% jump in US ten-year real yields would otherwise dictate. Part of the explanation being gold’s relative cheapness to real yields during the past six months while a softer dollar, increased stock market fluctuations as well as virus and geopolitical risks also helped off-set what otherwise could have been a very challenging start to the year.

Silver meanwhile was troubled by the slump in risk appetite as well as the weakness in bellwether industrial metals such as copper. After showing some end-of-year strength, the white metal succumbed to fresh technical selling which helped lift its relative cheapness to gold to a three-week high above 81 ounces of silver to one ounce of gold.

The outlook for 2022 remains clouded with most of the bearish gold forecasts being driven by expectations for sharply higher real yields. Real yields have, as seen below, throughout the past few years shown a high degree of inverse correlation with gold, and it’s the risk of a hawkish Fed driving yields higher that currently worries the market.

In our first precious metal update for the year titled “Gold and silver may spring a 2022 surprise” we highlighted the reasons why gold’s negative performance last year was on balance a good one from a relative perspective and what needs to happen for the metal to spring an upside surprise in 2022.

Gold remains stuck around $1800 within a wide $1740 to $1860 range, and key to the short-term direction is how it balances the opposite pulls mentioned from surging yields and raised market uncertainty.

Industrial metals were mixed with HG copper trading lower in response to the general loss of risk appetite and continued worries about the outlook for the Chinese property market, as well as the short-term growth impact from surging omicron cases leading to shutdowns across China. Aluminum, one of the most energy-intensive metals to produce, rose as recent supply disruptions added further fuel to expectations of a growing supply deficit this year. Not least considering the outlook for slowing capacity growth in China as the government steps up its efforts to combat pollution, and ex-China producers for the same reasons being very reluctant to invest in new capacity.

While the energy transformation towards a less carbon-intensive future is expected to generate strong and rising demand for many key metals, the outlook for China is currently the major unknown, especially for copper where a sizable portion of Chinese demand relates to the property sector.

Considering a weak pipeline of new mining supply, we believe the current macro headwinds from China’s property slowdown will begin to moderate through the early part of 2022. Not least considering the prospect of the PBOC and the government, as opposed to the US Federal Reserve, is likely to stimulate the economy, especially with focus on green transformation initiatives that will require industrial metals. With inventories of both copper and aluminum already running low, development could in our opinion be the trigger that sends prices back towards and potentially above the record levels seen last year. Months of sideways price action has cut the speculative length close to neutral, thereby raising the prospect for renewed buying once the technical outlook improves.

Crude oil traded higher throughout the first few trading days, thereby extending the end of December rally, while also going against the general trend of risk aversity seen across other commodities and asset classes. Supply disruptions in Libya, down more than 400,000 barrels a day compared with 2021, and geopolitical risks associated with rising fuel protests in Kazakhstan, a 1.9 million barrels a day producer, helped off-set any short-term demand worries related to surging virus cases around the world. Not least in China, where its aggressive handling of its worst Covid-19 outbreak since Wuhan could drive some short-term demand weakness.

OPEC+ agreed to maintain the current pace of monthly increases of 400,000 barrels a day and the market, despite the outlook for an emerging supply surplus this quarter, rose with the prospect of several producers not being able to meet their production targets. Besides the prospect of a global supply surplus, according to both the International Energy Agency as well as OPEC, emerging during the early parts of 2022, the futures market is also sending a signal about reduced participation.

The open interest which measures the total exposure, long and short, held by traders in WTI and Brent has fallen to the lowest in more than five years, and since the December 1 low point it has dropped further in recent weeks despite a price rally close to 20%. Perhaps a sign that many investors and traders remain skeptical about oil’s upside potential, at least during the early parts of 2022.

However, despite these signals we maintain a long-term bullish view on the oil market as it will be facing years of likely under investment with oil majors losing their appetite for big projects, partly due to an uncertain long-term outlook for oil demand, but also increasingly due to lending restrictions being put on banks and investors owing to a focus on ESG and the green transformation.

Global oil demand is not expected to peak anytime soon and that will add further pressure on spare capacity, which is already being reduced on a monthly basis, courtesy of OPEC+ production increases. Adding to this the prospect for a resumption of inventory declines into the second half and the risk of higher energy prices keeping inflation elevated, is the most likely route prices will take in 2022.

Source: Saxo Group

The European energy crisis shows no sign of finding a solution with the direction of gas and with that power prices remaining at the mercy of weather developments, the level of Russian supplies as well as the pace of LNG shipments reaching Europe.

During the past couple of weeks, the gas market has witnessed an extreme roller coaster ride. Before Christmas, very cold weather across Europe and the UK helped send EU benchmark gas to a level that was ten times higher than the long-term average. This was followed by a 65% price collapse in response to news that multiple LNG ships had changed course from Asia and South America to Europe in order to sell their gas at the highest price on the planet. A sudden turn towards milder-than-normal winter weather also helped, at least in the short term, to alleviate current concerns about very low stock levels of gas.

Into January and the price of gas has resumed its ascent, again with the prospect of colder weather driving increased demand for heating and unseasonably very low supplies from Russia, especially via two important pipelines through Poland and Ukraine. Whether Russia is deliberately keeping supplies down due to Nord Stream 2 pipeline approval delays and the Ukraine border crisis is difficult to say. But it highlights failed energy and storage policies in Europe and the UK which have left the region very dependent on imports of gas, especially given the still unreliable level of power generation from renewable sources.