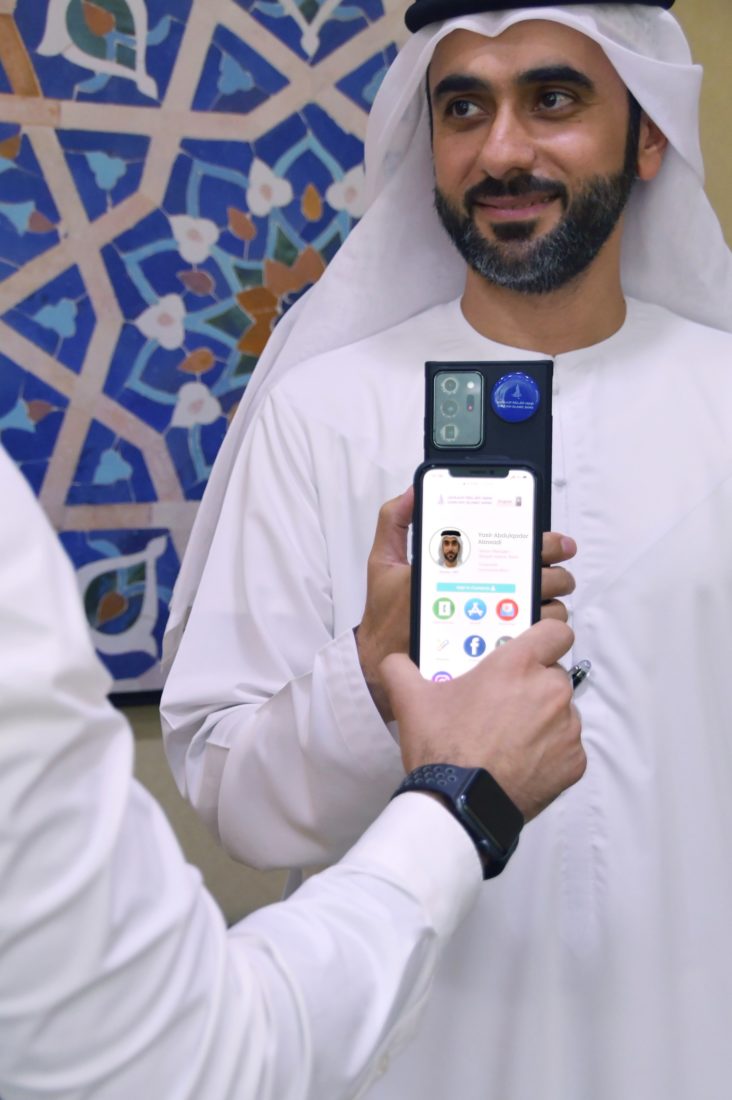

In line with the national agenda of the UAE Vision 2021, and with the aim of achieving a competitive knowledge-based economy backed by innovation, Sharjah Islamic Bank announced its cooperation with OZZ Technologies to provide a “digital wallet” service that allows bank employees to dispense with fully printed ID cards. Card data can also be saved and shared electronically in an easy and secure way.

Sharjah Islamic Bank is one of the first banks in the UAE to adopt this innovative technology, in line with the digital transformation strategy, to provide better ways to communicate in a simplistic and smooth futuristic manner. Digital wallet information can be shared securely while maintaining privacy, and enable employees to update their personal data and synchronize information from other direct links such as e-mail, mobile and web applications, and social networking sites of the bank. This is currently information not provided by traditional paper ID cards.

Adopting innovative technologies and smart means.

Hassan Abdalla Al Balghouni, Head of Corporate Communication at Sharjah Islamic Bank, stressed the bank’s keenness to adopt innovative technologies and smart means that contribute to achieving a qualitative leap in work procedures, and make it easier for employees, partners, and customers to access better services. He pointed out that the “digital wallet” gives employees greater flexibility to save, search and share data and reduce time wasted searching for contact information.

He says: “The digital wallet relies on Near Field Communication (NFC) technology, which is a wireless communication technology for transferring personal data directly via mobile phones. It also allows transferring of data by reading the barcode as an option and a secure additional feature.”

“Digital wallet” technology contributes to protecting the environment and natural resources by reducing the use of paper and ink and other related wastes, in addition to enhancing public health and safety by not dispensing with materials that are potential fertile environments for pollution. The technology also reduces contact and limits the chances of spread of the Corona virus, which maintains the safety of employees as well as clients.

Facilitate communication between the bank and its customers and partners

For his part, Ahmed Wasfie, founder and CEO of OZZ Technologies, expressed his happiness with this first-of-its-kind cooperation with a bank in the UAE, and pointed out that the “digital wallet” is distinguished by its ability to maintain, coordinate, and share a set of comprehensive and password-secured contact and identity information with others, which facilitates communication between the bank and its customers and partners.

Sharjah Islamic Bank continuously strives to provide all electronic services and facilities, which are designed to meet the requirements of the retail and corporate customers during the current period. The bank seeks to support the nation’s efforts to contain the Coronavirus under the slogan ” We Commit Until We Succeed,” and aligns with the UAE’s vision 2021, aimed at achieving a competitive and technology based advanced knowledge economy through innovation, along with the bank’s strategy to keep pace with the latest global digital banking technologies.